By Laurie Schreiber

Carbon storage, long-term forest health, wildlife habitat, and sustainable timber value and production in partnership with local communities are all part of the mission for a new timber investment fund that acquired its first parcel in the Piscataquis County town of Greenville.

Exemplary Forestry Management and its partners New England Forestry Foundation, Maine Mountain Collaborative and Quantified Ventures said Monday they launched an investment fund with the acquisition of the 3,000-acre Scammon Ridge Headwaters. The seller was the Haynes family of the Penobscot County town of Winn, according to a news release.

The acquisition was made using philanthropic, private and public capital.

The fund seeks both environmental and financial returns for investors and local stakeholders.

Climate-smart approach

“Exemplary forestry” was developed by the New England Forestry Foundation as a climate-smart approach to forest management.

Crafting the Exemplary Forestry Investment Fund took considerable research, planning and collaboration, said Robert Perschel, the foundation’s executive director and a fund board member.

According to Perschel, the approach is “unique in the conservation field.”

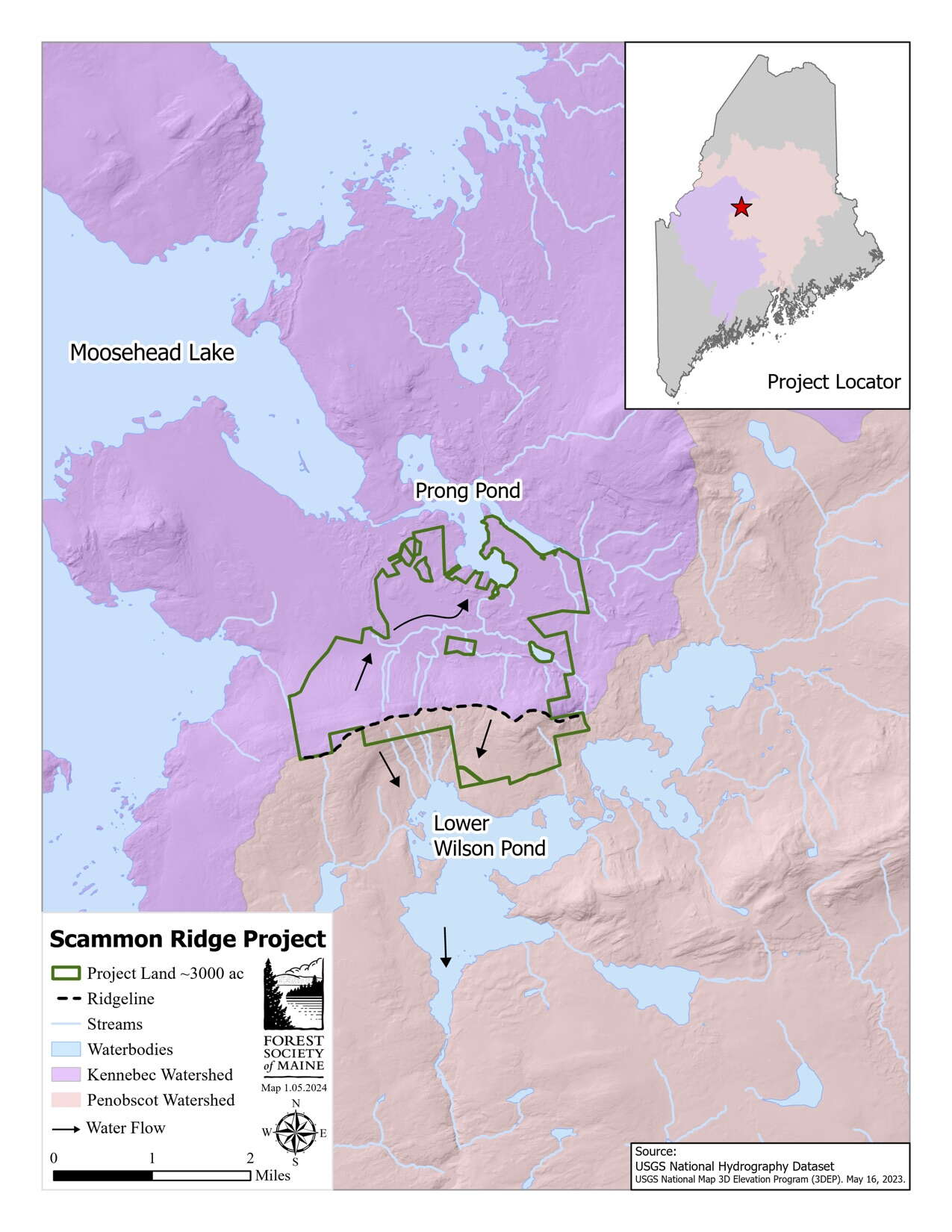

The Scammon Ridge project encompasses 3,000 acres. Courtesy / Forestry Society of Maine

He continued, “Now we’ll focus on judiciously scaling up this innovative program and building momentum, as we believe the Exemplary Forestry Investment Fund has immense potential to demonstrate to a global audience how productive, climate-smart forestry can be accomplished at scale.”

The acquisition of Scammon Ridge Headwaters included the sale by the fund’s board of a conservation easement to the Forest Society of Maine, which together with the Friends of Wilson Ponds Area raised money for the easement.

The purchase price was $3.71 million, which was the appraised value at the time of the purchase and sale contract, Bryan Wentzell, executive director of Exemplary Forestry Management, told Mainebiz.

How the deal was funded

Funding sources were as follows:

- Exemplary Forestry Investment Fund/Scammon Ridge Headwaters LLC equity investors: $1.68 million. The two largest investors are Elmina B. Sewall Foundation and Maine Community Foundation. The rest are individual investors. Investor capital was 94% from Maine.

- Low-interest loan from a Maine foundation: $500,000

- $1.9 million easement sale by Scammon Ridge Headwaters LLC to Forest Society of Maine.

The total was more than the purchase price due to closing costs and reserve capital for land ownership expenses until there is timber and carbon revenue in the coming years.

The fund is initially looking at acquisitions under 20,000 acres, Wentzell said.

“These tend to be too small for large carbon and timber investment funds, and properties the size of Scammon tend to be larger than what a local land trust might typically purchase,” he said.

“Also, it is important that we don’t compete with the conservation community — the fund comes out of the conservation community after all. If a property is most appropriate for public acquisition or purchase by a land trust, then we would support those outcomes.”

Wentzell emphasized that the seller, the Haynes family, sought out a conservation-oriented outcome.

The view of Scammon Ridge Headwaters from Prong Pond. Photo: Bryan Wentzell, courtesy of Maine Mountain Collaborative

The New England Forestry Foundation, which is based in Littleton, Mass., has conserved more than 1.2 million acres of forest since its founding in 1944, including one out of every three acres of forestland protected in New England since 1999. It also owns and manages more than 150 community forests across the region.

Maine Mountain Collaborative, based in Portland, is a coalition of statewide, regional and national conservation and forestry organizations with the goal to accelerate the pace and scale of conservation in Maine, considered one of the world’s most intact temperate forests.

Quantified Ventures, which is based in Washington, D.C., works with organizations to design, capitalize and scale investible solutions that aim to improve the well-being of people and the planet.

Exemplary Forestry Management, based in Portland, is a nonprofit launched by the New England Forestry Foundation and Maine Mountain Collaborative to manage the Exemplary Forestry Investment Fund.

The fund’s board aims to eventually own 100,000 acres of Maine forest by raising an estimated $90 million.

Goals

The fund’s goals would:

- Prove that a long-term investment model that delivers environmental and financial returns is viable in the forestry sector in the U.S.

- Conserve 100,000 acres under exemplary forestry management in the largest intact mixed temperate forest in the eastern U.S.

- Reach the landscape’s potential for timber productivity, volume and quality

- Sequester upwards of 30 metric tons of CO2e per acre more than present levels, and produce third-party verified carbon credits that can be sold for additional revenue; CO2e stands for “carbon dioxide equivalent,” which represents the number of metric tons of CO2 emissions with the same global warming potential as one metric ton of another greenhouse gas

- Increase timber stocking to 25 cords per acre, or almost 50% more than current levels

- Access new sources of capital by connecting project outcomes to a wider network of stakeholders.

“This innovative partnership and fund approach creates a new potential pathway for institutions and individuals to invest in the future of the Maine woods and support the many co-benefits that come from long-term forest health,” said Seth Brown, vice president at Quantified Ventures.

The fund is run and overseen by the nonprofit Exemplary Forestry Management, which comprises investment and forestry professionals, with on-the-ground operations handled by a forest management company.

The fund aims to own the land forever by allowing one group of investors to replace one another over time. Adherence to exemplary forestry standards is expected to be assured through the oversight of a board of directors with cross-disciplinary expertise in forestry, conservation, ecosystem markets and finance.

The Scammon Ridge Headwaters property is owned by Scammon Ridge Headwaters LLC as part of the fund’s initiative.

Located in central Maine in the town of Greenville, Scammon Ridge spans a high elevation ridge between Lower Wilson Pond, which is within the Penobscot River watershed, and Prong Pond, which lies within the Kennebec River watershed. The upland ridge portions of the property provide views of Moosehead Lake and the surrounding landscape.

Conserving the land is expected to ensure its habitat will remain undeveloped. At the same time, , the easement will allow the forest to remain available for year-round recreational activities and can continue to be managed for forest products, which bolster the regional economy.

Other organizations involved in the deal were Ropes & Gray LLP, a law firm headquartered in Boston; the Innovative Finance for National Forest grant program, a program funded and managed by the U.S. Forest Service and the U.S. Endowment for Forestry and Communities; Natural Resources Conservation Service Conservation Innovation Grant; the Forest Society of Maine and Friends of Wilson Ponds, which led the fundraising on the Scammon Ridge easement; and local residents and camp owners.

The land known as Scammon Ridge Headwaters is on the unceded homeland of the Wabanaki People.